Blake Swanson

Introduction

The Coronavirus of 2019 will go down as one of the most influential and impactful events since the tragedy that occurred on September 11th, 2001. There is no escape from this pandemic. Every single person on our planet of over 7 billion people has been affected in some form or fashion. Whether that impact is physical, financial, emotional, or some other way. There have been unprecedented changes occurring throughout the United States. The stock market and businesses have been hit particularly hard. Countrywide shutdowns have caused panic and forced people to adapt to a new way of life. COVID-19 has drastically changed how small businesses in the United States operate in today’s society, forcing them to rely on technology, such as online shopping, social media, and web communications via zoom or similar platforms. These changes in operations have had major financial impacts on small businesses and small business workers.

Connection to STS Theory

The new change in how businesses operate has ended an age-old path dependency and has created a new one that is up to 21st century standards. From the time the first business was founded there was one thing that was common to all businesses. This one commonality was that they all centered around in-person and human interaction. Of course, as there is with everything, there are a few exceptions like Amazon. However, the old has gone and the new has come. A new path dependency has been created for businesses. This path dependency no longer relies on person to person interaction but now relies on technology. Before COVID-19 we saw many companies slowly transitioning more and more to online platforms. The pandemic drastically boosted this transition to the point where almost all businesses are online to some degree.

A Change in Operations

In the United States during the early stages of the pandemic, an almost countrywide lockdown went into effect. Florida, California, and New York all declared a state of emergency and made decisions on their plan of action as early as March 7th, 2020. The rest of the country followed suit. Every state had declared a state of emergency and released their game plan by the end of March. 92 percent of states declared some form of stay at home order beginning in March. Another 94 percent of states closed all nonessential businesses and 100 percent closed schools. Only 2 states in the whole country did not shut down bars and sit-down restaurants (“U.S. State and Local”). These stay-at-home orders and shutdowns lasted for months in many states and in some cases haven’t even been fully lifted in a few states. The lockdowns would have many repercussions on the stock market and businesses in our country, especially for small businesses. The Coronavirus pandemic has forced small businesses to adapt to new ways of conducting business or suffer the consequences.

The pandemic and the lockdowns that came with it have brought many small businesses fully into the 21st century. Without being able to conduct their services in person like normal many businesses were forced to build or drastically increase their online presence in order to survive. The first change made by small businesses in the United States was to either build or upgrade their business’s website. A study by the National Bureau of Economic Research (NBER) found that 52.5% of small businesses responded to the crisis by providing online services, 35.1% expanded digital payments, 25.7% used delivery services, and 24.4% used curbside pickup (Alekseev et al.).

For small businesses in retail, this could mean reaching out to businesses like Amazon and Google Shopping with the hopes of selling their products through these vendors. Many small businesses in the retail sector used Walmart as a guide for their change in operations. Shortly before and during the pandemic, Walmart unveiled a couple of new ways of shopping at their stores. The first is called Walmart pickup. Walmart curbside pickup allows you to place an order online and then schedule a specific time to pick it up at the curb (a designated parking spot) and have a Walmart employee load it into your car or trunk (McGrath). The second option is called Walmart deliveries. Walmart delivery is virtually the same as Walmart pickup. However, delivering straight to your door will cost you an extra fee and you can track your driver straight up to your front door (Garrity). This new form of conducting business has been a lifeline for many small businesses, those who can afford it at least. For those in the hospitality sector reaching out to companies like UberEATS and Grub Hub could save the life of their small business. Since the beginning of the COVID-19 crisis, around 60 percent of restaurants in the country have added curbside pickup, and more than a third of consumers who have ordered food for in-store or curbside pickup were first-time users of the service (Dua et al.).

Another change many businesses made was to increase their social media and advertising presence. In an interview with the United States Chamber of Commerce, Loryn Purvis, owner of Picnic Artisanal Grazing in California stated,

“We have relied on social media for 100% of our business. I began this business in April after the cooking school I teach at had been closed for over a month due to COVID-19. I posted one picture of a grazing box and let my friends know I wanted to give away five of them to whoever could use a pick-me-up. Those friends each posted a photo of their box on social media — not because I asked them to, but because the product itself is too pretty not to share — and things quickly snowballed from there. People love photographing their food and sharing the fun things they are enjoying, especially right now when it can be hard to find fun, and that was a huge advantage for my business” (Forstadt).

During the lockdown, businesses weren’t allowed to conduct any in-person business so employees were forced to work from home. It was found that out of the 55.5 percent of small businesses that were able to keep all of their workers, only 29.3 percent were able to let all of their employees work from home (Alekseev et al.). The fortunate businesses who were able to let their employees work from now had to find a way to efficiently communicate with their employees. Many businesses did so through platforms like Zoom, Google Meet, and Microsoft Teams. They operated very similarly to many schools and college campuses across the country.

As the lockdowns and restrictions began to be lifted, many businesses were able to open once again. They had to follow a long list of new CDC guidelines. Employers are told to conduct daily health checks and hazard assessments of the workplace, encourage workers to wear face masks, implement policies of social distancing, disinfect regularly, and, if possible, update the building’s ventilation system. Employees are encouraged to wear face coverings, wash hands regularly, use hand sanitizer with at least 60% alcohol, and avoid long amounts of exposure to others (“Workplaces and Businesses”).

The Financial Effects on Small Businesses

The lockdowns and new changes in how small businesses operate have had major effects on the financial aspect of small businesses. In a survey of 5,800 small businesses by Proceedings of the National Academy of Sciences (PNAS), it was determined that 41.3% of businesses reported that they were temporarily closed because of COVID-19 (Bartik et al.). This put a major strain on the financials of these small businesses. In a survey of roughly 66,000 small businesses taken by the National Bureau of Economic Research (NBER), many businesses were struggling to pay bills (31.3%), rent (24.9%), wages (24.1%), and debt obligations (23.0%). About 42% of businesses reported having more outflows than inflows in the past month, and 78.2% of businesses were concerned about cash flows (Alekseev et al. 2).

Many small businesses have been forced to seek help from the government to try and keep their business afloat. An impact poll surveying 500 small businesses was taken by the U.S. Chamber of Commerce with the help of MetLife. The resulted showed that one in five (19%) small businesses have applied for and received a Paycheck Protection Program (PPP) loan. In total, 39 percent of small businesses have applied or tried to apply, for a PPP loan. Among those who received the loan, 64 percent are concerned about meeting the criteria necessary to receive loan forgiveness (United States Chamber of Commerce).

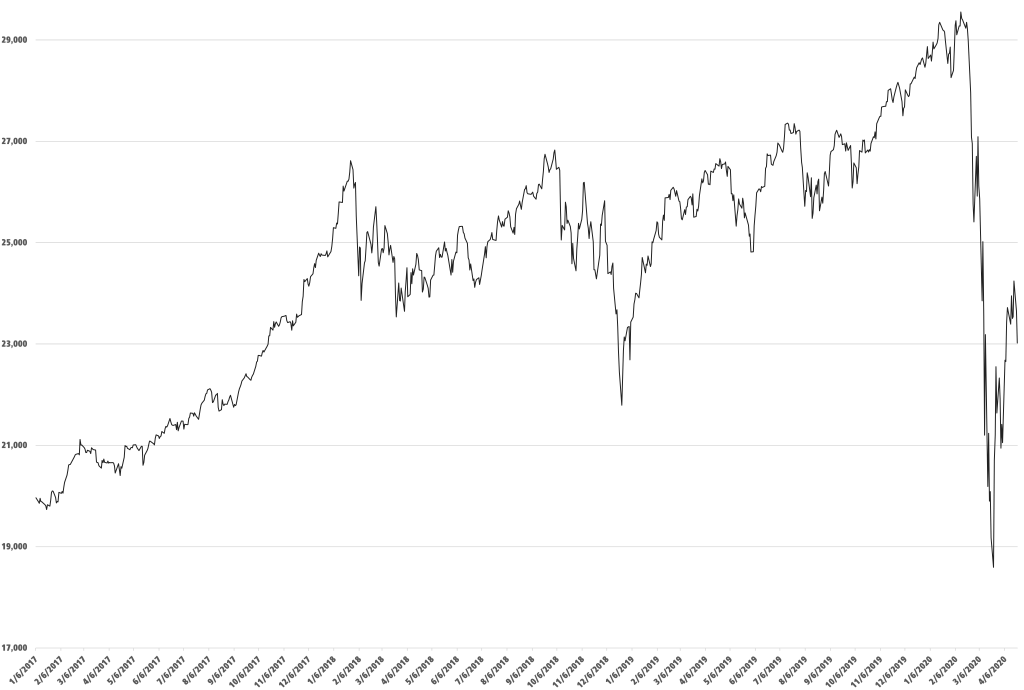

Sometimes even government loans aren’t enough and some businesses have been forced to close permanently. NBC wrote a news story called Misery on Main Street. The article discussed a first-hand account from a business in Scranton, Pa about the fatal toll COVID-19 has had on small businesses Many small businesses like Brunetti’s Pizza and Deli in Scranton, have to keep up payments to suppliers but business is extremely low so no profits are made. Even federal loans sometimes can’t save a business from going under. Brunetti’s with only 100 dollars in their bank account at the start of summer was forced to shut down (Morgenson). This is a reoccurring theme in many cities across the country. During the early stages of the pandemic and lockdowns, the stock market experienced one of the worst crashes that we have seen in decades. A major drop in the stock market occurred in the months of March and April. The stock market tends to reflect how business is doing as a whole, mainly bigger businesses. A drop of this magnitude gives a very visual representation of how terrible many small businesses are doing during this time.

The Financial Effects on Employees of Small Businesses

The lockdowns, strain on small businesses, and new changes in operations have had major effects on the financials of many small business employees. More than 95 percent of all businesses are small businesses, and they employ about half the US workforce (“Coronavirus Business”). So, the closings and negative impacts on small businesses have affected a large number of Americans. A record number of 3.28 million Americans filed for unemployment between March 21st and April 21st (“Coronavirus Business”). The survey was taken by NBER also stated that 44.5% of businesses reduced the number of active employees, through a combination of furloughs and layoffs. The employees who were lucky enough to not get fired had to adjust to working from home. Not everyone has the technology to efficiently work from home. Many Americans had to buy new laptops or computers and, in some cases, upgrade their Wi-Fi to a higher speed. The employees of these small businesses are working-class Americans so many of them do not have money saved up for such a crazy and impactful event. Finding new jobs and the money to support themselves caused a lot of stress and anxiety for many small business employees.

The Big Debate

Now that we are out of the very early stages of the pandemic many people are beginning to debate whether the actions that were taken were worth the financial turmoil it caused. One side claims that there were already 200,000 deaths from COVID-19 even with the lockdowns and restrictions. There could have been hundreds of thousands more maybe even millions more if we didn’t take the precautions that we did (“Provisional Death Counts”). No amount of money can equal a human life so we cannot equate the financial loss to human loss. The other side claims the harm done by the lockdowns and restrictions outweigh the good. The financial and emotional toll taken on the American people is catastrophic and nothing will change that. They also claim that the lockdowns did not erase the virus but only delay its spread so they were ineffective (M-K).

Conclusion

This unprecedented pandemic has created a new precedent for how businesses will operate in the future. The positives of this pandemic may have been few and far between but the few that did arise will have a long-lasting impact. Many businesses have now been boosted into the 21st century. New ways of conducting business that may have never been thought of are now in full effect.

References

Alekseev, Georgij, et al. “The Effects of COVID-19 on U.S. Small Businesses: Evidence from Owners, Managers, and Employees.” National Bureau of Economic Research Working Papers, 2020. http://www.nber.org/papers/w27833.

Bartik, Alexander, et al. “The impact of COVID-19 on small business outcomes and expectations.” Proceedings of the National Academy of Sciences of the United States of America, 28 July 2020, http://www.pnas.org/content/117/30/17656 Accessed 30 Nov. 2020.

Coronavirus Business & Economy Impact News. The Business Insider, 2020, http://www.businessinsider.com/coronavirus-business-impact Accessed 30 Nov. 2020.

Dua, Andre, et al. “US small-business recovery after the COVID-19 crisis.” McKinsey & Company, 7 Aug. 2020, http://www.mckinsey.com/industries/public-and-social-sector/our-insights/us-small-business-recovery-after-the-covid-19-crisis Accessed 30 Nov. 2020.

Forstadt, Andrea. “Using Social Media to Promote Small Business During COVID-19.” CO, 3 Sep. 2020, http://www.uschamber.com/co/good-company/growth-studio/promoting-business-on-social-media-during-pandemic Accessed 30 Nov. 2020.

Garrity, Amanda. “Walmart Has a “Refer-a-Friend” Promo That Will Give You and a Loved One $10 Off Groceries.” Good Housekeeping, 30 Mar. 2020, http://www.goodhousekeeping.com/life/a31981503/walmart-online-grocery-shopping-delivery/ Accessed 30 Nov. 2020.

McGrath, Kristin. “How to Use Walmart Curbside Pickup for Groceries and More.” Offers.com, 27 Oct. 2020, http://www.offers.com/blog/post/walmart-curbside-pickup/ Accessed 30 Nov. 2020.

Morgenson, Gretchen, et al. “Misery on Main Street: COVID-19 takes a grim toll on America’s small businesses.” NBC News, 23 Sep. 2020, http://www.nbcnews.com/business/economy/misery-main-street-covid-19-takes-grim-toll-america-s-n1239524 Accessed 30 Nov. 2020.

M-K, Gideon. “Are COVID-19 Lockdowns Worth It?” Medium, 12 Oct. 2020, https://gidmk.medium.com/are-covid-19-lockdowns-worth-it-5b0bc0fd994a Accessed 30 Nov. 2020.

“Provisional Death Counts for Coronavirus Disease 2019 (COVID-19).” Centers for Disease Control and Prevention, 30 Nov. 2020, http://www.cdc.gov/nchs/nvss/vsrr/covid19/index.htm Accessed 30 Nov. 2020.

United States Chamber of Commerce. “July 2020 Small Business Coronavirus Impact Poll.” U.S. Chamber of Commerce, 27 August 2020. http://www.uschamber.com/report/july-2020-small-business-coronavirus-impact-poll Accessed 30 Nov. 2020.

“U.S. state and local government responses to the COVID-19 pandemic.” Wikipedia, 27 Nov. 2020, https://en.wikipedia.org/wiki/U.S._state_and_local_government_responses_to_the_COVID-19_pandemic Accessed 30 Nov. 2020.

“Workplaces and Businesses.” Centers for Disease Control and Prevention, (n.d.), https//www.cdc.gov/coronavirus/2019-ncov/community/workplaces-businesses/index.html?CDC_AA_refVal=https%3A%2F%2Fwww.cdc.gov%2Fcoronavirus%2F2019-ncov%2Fcommunity%2Forganizations%2Fbusinesses-employers.html. Accessed 30 Nov. 2020.

Images

“Uber Eats Delivery” by Wistula is licensed under CC BY-SA 4.0

“Stock Market Crash (2020)” by Cole Locke is licensed under CC BY-SA 4.0

“Businesses Permanently Closed Due to COVID” by Pixabay is in the Public Domain, CC0